Litepaper

Inception and Vision

It began with a deceptively simple question: What is money, actually?

In the modern financial system, money is not something that simply exists—it is created. Unlike the image of vaults filled with pre-minted bills, the reality is far more abstract. Today, money comes into existence through lending, a process controlled largely by banks. When a financial institution approves a loan, it does not simply redistribute existing funds; instead, it conjures new money into being—numbers on a screen, a balance on a ledger, a promise backed by trust.

So why not rethink who gets to create money? And how?

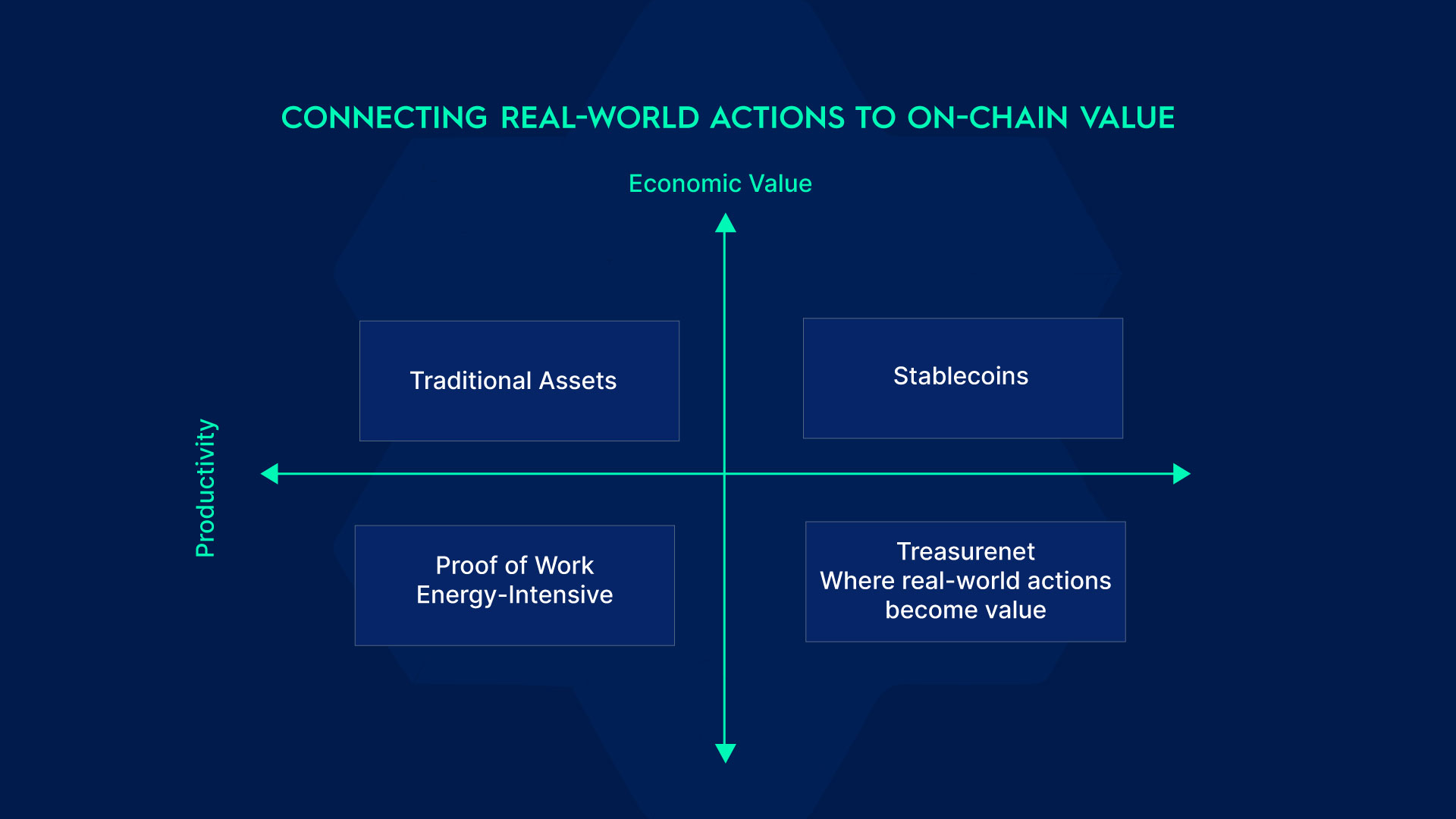

That's where Treasurenet comes in: a protocol where your real world actions turn into on-chain value.

Treasurenet: Where Productivity becomes Tradable Value

Treasurenet proposes an alternative: a financial architecture where value is rooted in verified, measurable productivity—and the system rewards those who produce, not just those who speculate.

The New Economic Paradigm

- Your work builds your wealth—directly.

- **Your on-chain reputation is a financial asset—**it earns you access, credit, and rewards.

- Your action generates tradable value—real output becomes a digital token.

- Your contributions are transparently rewarded—every transaction, verifiable on-chain.

While Treasurenet's starting point is oil and gas, our vision extends far beyond. We're focused on expanding asset connections and building the infrastructure needed to support real-world assets across a range of sectors—from telecommunications to data monetization and digital commerce. Our goal is simple: to create a trusted network where real people can do real things, seamlessly and securely, using Treasurenet.

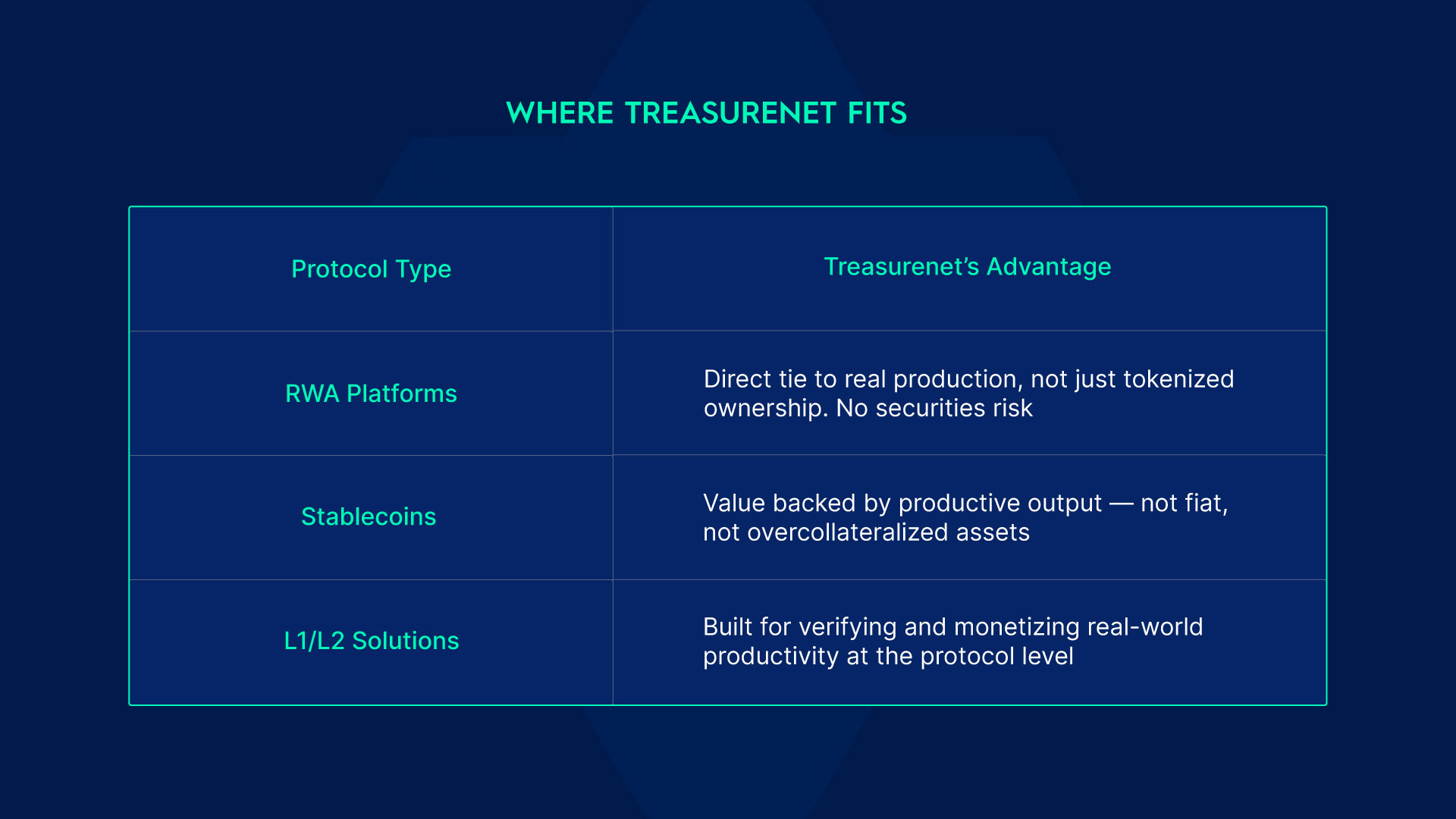

Market Analysis: Where Treasurenet Fits

Treasurenet creates a new category in the blockchain ecosystem:

- Unlike RWA platforms, it values production metrics, not just ownership

- Unlike stablecoins, its stability derives from productive output

- Unlike standard blockchains, it's built specifically for productivity verification

Our asset-based consensus mechanism, recognized with an 'A' rating by the World Intellectual Property Organization, fundamentally reimagines how digital currency is created—not from energy use or financial collateral, but from verified real-world productivity.

System Design: How Treasurenet Works

Treasurenet is built on Proof of Actual Value. Unlike speculative token minting, Treasurenet ties digital currency issuance to real-world productivity—recorded, verified, and secured on-chain.

- Rep: Rep is your On-Chain Reputation Score. Verified work earns you Rep, which gives you credibility and unlocks more opportunities on-chain in the future.

- Eg- $100k worth of oil or energy production equals 100k Rep

- Rep does not represent asset ownership but serves as your activity audit tool. It also determines creditworthiness for minting TCash and calculating block rewards for UNIT.

- Eg- $100k worth of oil or energy production equals 100k Rep

One of the key aspects that actually makes this financial Lego-like protocol possible is the tokenomics that "bind" together producers and the financial system. More specifically:

-

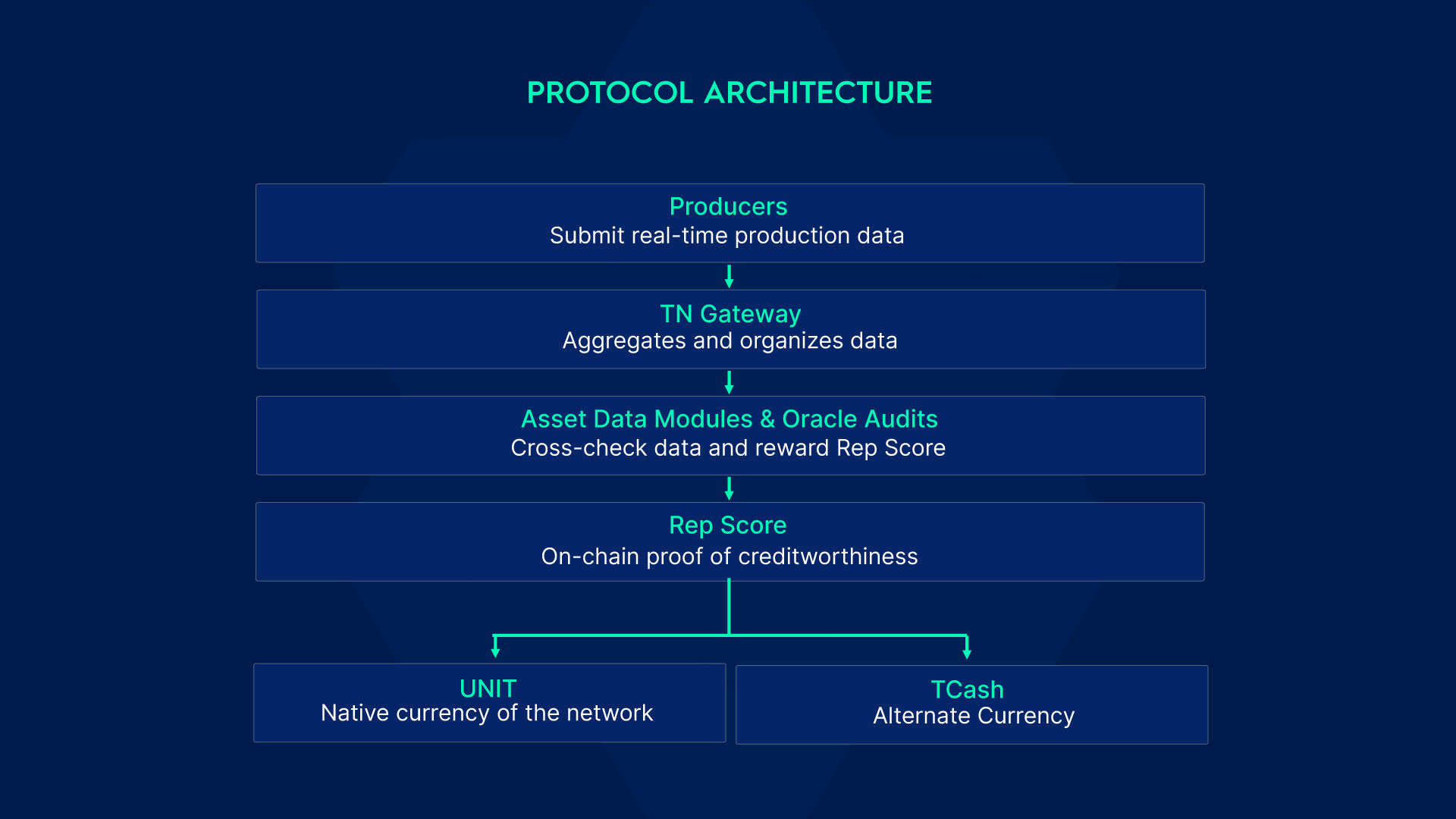

UNIT Token: The governance- native token of Treasurenet. Unlike traditional fiat, UNIT tokens are disinflationary and minted as block rewards through verified productivity. Think of it as digital gold for the Treasurenet economy.

-

TCash: An alternative currency that can be used for everyday transactions and is minted through collateralized loans using UNIT and governed by Rep credit scoring. TCash serves as the primary medium of exchange within the Treasurenet ecosystem.

Proof of Actual Value: System Flow

Unlike asset-backed tokens that rely on centralized promises, Treasurenet runs on an asset-based model.

Here's how it works:

- Prove Your Work: Real-world activity is measured, verified, and recorded on-chain.

- Earn Rep: The more you produce, the higher your Rep Score. It's your creditworthiness in the Treasurenet economy.

- Mint UNIT: Rep earns you UNIT tokens through block rewards.

- Get Liquid: Collateralize UNIT to mint TCash for real-world spending.

This process creates a self-sustaining loop where increased productivity drives token issuance, liquidity, and broader adoption.

Technical Specifications: Secure, Scalable, and Interoperable

Treasurenet is built using Cosmos SDK, Ethermint, and Tendermint Core, running on a Byzantine Fault Tolerant (BFT) Proof-of-Stake consensus mechanism.

- 10,000 TPS → High throughput, no bottlenecks.

- 2-3 Second Finality → Fast, efficient transactions.

- IBC-Enabled → Seamless cross-chain interoperability with Ethereum and beyond.

- Modular Smart Contracts → Expandable and customizable applications.

- Verifiable Data Oracles → Secure data feeds for productivity verification.

Protocol Architecture and Economic Mechanism

Treasurenet protocol connects physical world productivity with digital financial systems through an integrated layered architecture. Each layer serves a specific purpose while working cohesively to create a sustainable ecosystem.

1. Protocol Architecture

1.1 Producers: Core Participants

Producers form the economic backbone of Treasurenet. By contributing real-world value, they anchor the network's token supply to tangible productivity. Think of energy providers, commodity producers, and digital asset miners. Their production data is reported using hardware meters and transparently verified on-chain.

Key Process:

- Producers submit real-time data via the TN Gateway.

- Verification is handled by modular asset data systems.

- Upon validation, they receive a Rep Score as proof of productivity.

The more they produce, the more credibility they build.

1.2 TN Gateway: Real-Time Data Flow

The TN Gateway is the protocol's API hub, seamlessly connecting blockchain operations with real-world data. It handles:

- Data Aggregation: Collects verified metrics from hardware meters.

- Data Organization: Structures information for transparent Reporting.

- Data Transfer: Bridges on-chain and off-chain environments.

Key Benefits:

- Producers: Effortlessly submit production data.

- Developers: Build dApps with clean, structured data.

- Auditors: Conduct transparent cross-verifications with ease.

Privacy remains a priority through governance, ensuring secure data management.

1.3 Asset Data Modules & Oracle Audits

Different industries demand tailored verification methods. Treasurenet employs modular data validation to ensure accurate productivity assessments.

How It Works:

- Producers submit data through TN Gateway.

- Oracles cross-check the data using reliable public sources.

- Upon verification, Producers are rewarded with their Rep score

- Future verification modules will be proposed and voted on through DAO Governance, ensuring adaptability and expansion.

1.4 Rep Score

Rep Score is your on-chain scorecard, reflecting real-world contributions with full transparency. With Rep, Producers gain access to Treasurenet's dApps, establish creditworthiness, and contribute to network growth.

Core Functions of Rep

- Proof of Creditworthiness: Producers establish on-chain Reputations, accessible to lenders for asset-based financing.

- Collateralization: Producers can lock Rep as collateral without liquidating assets.

- Asset-Specific Indexing: Rep tracks sector-specific productivity, offering real-time insights into asset growth.

- Super Validator Rewards: Burn Rep to gain enhanced rewards and network influence.

2. Tokenomics

2.1 UNIT

UNIT is Treasurenet's governance native token. Unlike tokens backed by reserves, UNIT derives its value from actual output. As production increases, UNIT supply grows in sync, establishing a direct link to real-world productivity.

Where Bitcoin follows a rigid 50% reward reduction per halving period, UNIT employs a more nuanced approach. Block rewards decrease proportionally to the volume of Rep minted, creating a direct link between token generation and tangible asset creation.

2.2 Key Advantages of UNIT

- Not a Security: UNIT sidesteps securities classification by deriving value from real-world production, not financial speculation.

- Dynamic Supply: Token supply grows in sync with verified asset creation, eliminating artificial scarcity.

- Incentive Alignment: UNIT rewards those contributing to the economy, not just computational work.

2.3 Core Functions of UNIT

The token serves multiple critical functions:

Network Economics

- Primary utility token for transaction fees

- Mechanism for value transfer

- Foundational to network operations

Consensus and Security

- Validators must stake UNIT tokens

- Provides economic incentive for network protection

- Rewards participants for maintaining network integrity

Governance�

- Enables decentralized decision-making

- Token holders vote on platform proposals

- Ensures community-driven evolution

Validator Dynamics

- Staked UNIT tokens determine validator selection

- Rewards are distributed proportionally to contribution

- Creates a meritocratic validation ecosystem

2.4 How UNIT is Created

New UNIT tokens are issued as block rewards. The number of rewards is dynamically adjusted based on the production of Rep badges that represent verified RWA output.

Here's the Target Rate Mechanism Flow:

- Target Rate Assessment: Each period, Treasurenet compares actual RWA production rates to a Target Rate set by the DAO Governance.

- Block Reward Adjustment: Based on this comparison, block rewards are reduced within a defined range to maintain economic balance.

2.5 The Three Scenarios of Token Generation

1. Falling Short of Target

- RWA production below expectations

- Block rewards reduced by 10% to 50%

- Encourages increased asset-creation efforts

2. Meeting the Target

- RWA production aligns with expectations

- Moderate block reward reduction of 10%

- Maintains economic balance

3. Exceeding the Target

- RWA production surpasses expectations

- Minimal block reward reduction of 1% to 10%

- Rewards overachievement in asset generation

2.6 Who Earns UNIT?

UNIT and Rep determine how rewards are distributed. Each block reward is allocated to validators based on their actions:

Validator Rewards & Participation

Rewards are allocated to two categories of nodes:

- Active Validator Nodes: Stake UNIT to receive base rewards.

- Active Super Validator Nodes: Stake UNIT and burn Rep through bids to receive both base rewards and additional Super Validator Rewards.

Super Validator Rewards are projected to represent 30% of total block rewards. Competitiveness in Rep bids and node participation will determine actual allocation.

2.7 Key Parameters:

- Period duration: 1 year (measured in blocks)

- Initial block reward: 10 UNIT/block (fixed for first two periods)

- Target production growth rate: 10%

- Maximum block reward reduction: 50%

- Minimum block reward reduction: 1%

- Growth rate distribution model: PERT [-50%, 15%, 500%]

Long-term simulations project total UNIT supply between 700-800 million tokens over 500 years, dynamically reflecting real-world productivity growth

3. TCash

TCash is Treasurenet's alternate currency designed for seamless capital movement. Unlike traditional stablecoins pegged to USD, TCash maintains stability by responding to market forces, much like fiat currencies without rigid benchmarks.

Core Functions:

- Cash: Facilitates everyday transactions.

- Credit: Enables decentralized borrowing and lending, supported by on-chain collateral and credit scoring.

3.1 Collateralized Lending: How It Works

TCash employs a bank-like model where loans are issued against collateral. Users lock UNIT tokens as collateral to borrow TCash, ensuring every TCash in circulation is backed by UNIT tokens of greater value.

Borrowing TCash

- Qualification: Users collateralize UNIT to borrow TCash.

- Loan Calculation:

Loaned TCash = (Collateral UNIT × UNIT Price × Risk Coefficient) ÷ TCash Price - Borrowing Limits: Minimum of 0.000000001 TCash. Cannot exceed calculated borrowable amount.

3.2 Qualification and Growth

- New Users: After minting Rep twice, users can borrow up to 3x their average unutilized Rep over the last 3 months.

- Established Users: With a positive lending history, borrowing limits expand up to 12x.

3.3 Dynamic Risk Assessment

- Personalized Borrowing Capacity: Assessed through user behavior and platform activity.

- Adaptive Risk Coefficients: Adjusted dynamically based on network data.

- Real-Time Price Monitoring: Oracle networks ensure accurate asset valuations.

3.4 Supply Mechanism

- No Fixed Cap: Initial supply of 1,000,000 TCash.

- Dynamic Minting: New tokens issued via personal loans.

3.5 User-Friendly Loan Management

- Flexible Repayment: Partial or full Repayments with proportional collateral returns.

- 365-Day Loan Term: No penalties for Repayments within one year.

- Transparent Dashboard: Real-time visibility on loans, collateral, and risks.

3.6 Protection Mechanisms

- Early Warnings: Users notified when collateral nears risk thresholds.

- Collateral Management: Option to add more collateral to prevent liquidation.

- Transparent Liquidation: Clear, fair rules for collateral liquidation.

3.7 Real World Application

TCash powers real-world economic activity:

- Business Settlements: Native dApps and other ecosystem applications will rely on TCash for transactions.

- Stable Unit of Account: Transparent pricing without volatility.

- Enterprise-Ready: Designed for both individual and commercial applications.

4. Token Distribution

Treasurenet's token launch puts contributors and ecosystem first. The genesis supply of 90,000,000 $UNIT is allocated to reward early participants, align long-term supporters, and ensure liquidity from day one.

4.1 Distribution Structure

The initial 90,000,000 UNIT tokens are allocated across the following segments:

- Community Airdrop (40.25%) - Early contributors to the Treasurenet mainnet are directly rewarded through the community airdrop, driving organic growth and grassroots participation from the start.

- Founding Investors (20%) - Long-term aligned investors who share the vision for Treasurenet's development receive a dedicated allocation.

- Protocol Reserve (23%) -Strategically held to fund ecosystem initiatives, liquidity programs, grants, and future community-driven proposals aligned with long term protocol growth.

- Team Reserve (10%) - Allocated to core contributors with a clear vesting schedule, ensuring incentives are tied to long-term network success. Only unlocked tokens are eligible for staking to maintain network security.

- Early Producers (6.75%) - Reserved for individuals who contributed during Treasurenet's critical pre-launch phase. These tokens unlock linearly over 12 months.

✅ Total supply: 90M $UNIT distributed with alignment to real usage, long-term participation, and minimized short-term speculation.

This distribution ensures that the people building and supporting Treasurenet—validators, developers, and early users—have a real stake in its success. Lower barriers to entry mean more room for innovation and participation from Day 0.

4.2 Distribution Mechanics

- Network Exclusivity: UNIT tokens distributed via airdrop will initially function exclusively on the Treasurenet mainnet, with controlled bridge implementations for cross-chain liquidity.

- Linear Vesting: Early producer allocations (6.75% of supply) unlock linearly over 12 months without cliffs, ensuring sustained participation through the protocol's initial growth phase.

- Team Alignment: Core team tokens (10% of supply) are subject to vesting schedules with staking eligibility limited to vested tokens only, creating long-term alignment with protocol success.

- Founding Contributor Requirements: Wallets receiving founding contributor allocations (20% of supply) maintain mandatory staking participation to ensure active network security contribution.

4.3 Staking Access

Staking is permissioned for value-aligned holders. Vested team tokens, early contributors, and certain investors can participate. Airdrop allocations (unvested and unallocated) are staking-ineligible.

This is intentional: staking is designed to reinforce long-term participation, not passive liquidity.

5. System Integration

The Treasurenet protocol integrates its components through a sequential flow:

- Producers generate measurable output (energy, compute, digital assets)

- Hardware meters capture and attest to production metrics

- TN Gateway transmits data on-chain through standardized APIs

- Oracle networks validate data against external sources

- Rep Scores are minted based on verified productivity

- Rep enables UNIT minting, TCash access, and protocol services

- Production growth drives money supply expansion and network growth

This integrated architecture creates a self-reinforcing ecosystem where real-world productivity directly fuels protocol development and financial expansion.

Native dApps Under Development

We are going to release a native dApps that mirrors real world yield. Here's how it will work:

1. Producers → Rep

Participants in the real world (e.g., energy producers, resource extractors) perform measurable work. That activity is verified in real-time and translated into a Rep Score — an on-chain measure of productivity, precision-engineered to be trustless and transparent.

2. Contributors → Yield Pools

Holders of TCash can allocate capital into Yield Pools tied to specific Rep-generating producers. These pools are not abstract—they are connected to asset-producing activity that's verifiable on-chain.

3. Yields → Based on Performance

Returns are generated and streamed based on actual productivity. The stronger the producer's Rep score, the more attractive the yield.

Smart Incentives:

- Contributors assess Rep before depositing — or choose to swap TCash on open markets

- Yields are auto-distributed to wallets based on verified returns — no intermediaries, no friction

- If producers underperform, they lose Rep, and future capital dries up

Use Cases

- Asset Financing Platform: A decentralized lending hub where users can leverage verified RWAs using Rep as both collateral and a risk gauge. No double-borrowing tricks — one asset, one loan. Rep also powers dynamic loan-to-value ratios and interest rates, fully automated. No middlemen. Just transparent, on-chain finance.

- RWA NFT Marketplace: Tokenize assets like gold, silver, or oil. Unlike traditional NFT platforms, Treasurenet validates asset productivity using Rep. Earnings are tracked on-chain, offering true transparency.

- Decentralized Insurance: Cover your RWAs without corporate gatekeepers. Smart contracts, powered by real-world data from Treasurenet, handle claims and payouts.Policyholders get fair coverage without reliance on centralized insurers.

- RWA Leasing Platform: Tokenize your asset, lease it out, and get paid in crypto or stablecoins. Rep tracks asset performance on-chain, giving everyone full visibility. No disputes. Just automated, smart-contract-managed leasing.

- Commodities Marketplace: Trade commodities on a fraud-proof, blockchain-based exchange. Rep tracks every movement, from production to delivery. No dodgy intermediaries. Just transparent trading.

- Bet on Real Value: With Rep measuring real-world productivity, derivatives trading becomes clearer and safer. No shady metrics — just actual data, straight from the source.

- Layer 2, Built For You: Industries are different. Treasurenet gets it. Custom Layer 2s ensure oracles deliver the right data for the right market. No fluff. Just actionable insights.

Strategic Roadmap and Development Path

Q2 2025

LAUNCH THE CORE ECOSYSTEM

- Token Generation Event (TGE) for Unit & TCash

- Community Unlock token distribution

- Deploy cross-chain bridge to Ethereum

Q3 2025

ENABLE REAL-WORLD-LINKED FLOWS

- Launch dApp for activity-based distribution cycles

- Open community proposals for new asset onboarding

- Run Testnet and dev challenges to stress test and scale the network

Q4 2025

DESIGN FOR SCALE

- Begin R&D for asset-specific infrastructure solutions

- Enable asset validation across multiple networks

- Gather community feedback on scaling strategy

2026 Roadmap

EXPANSION & ENTERPRISE INTEGRATION

- Deploy infrastructure solutions for energy, logistics, and manufacturing

- Bring on-chain infrastructure for industry-scale use cases in energy, logistics, and manufacturing

Team Expansion:

- Throughout the year, actively recruit for key roles in Security, Trading, and Development to scale operations effectively.

About The Team

Treasurenet is built by a hands-on team of blockchain developers and finance professionals who want to bridge real-world assets with decentralized systems.

The Treasurenet team, originally set up in 2023 as a non-profit organization and now based in Hong Kong, keeps things running.

Its job? Simple:

- Manage and grow the Treasurenet protocol.

- Educate people about how it works.

- Build online and offline communities.

- Keep decision-making transparent and fair.

- Help expand Treasurenet's network.

Strategic Backing

Since 2021, Treasurenet has worked with major oil and gas asset producers to bring real-world backing to the platform. The team behind it? Experienced blockchain builders and financial experts who know what it takes to build something stable and scalable.

The goal has always been clear: Connect Traditional finance to the future of DeFi. And now, it's live — creating real-world impact, one transaction at a time.

Why It Matters

Traditional credit systems are restrictive and favor established players. By linking credit and liquidity to measurable productivity, the protocol provides fair access to economic growth for businesses and individuals.

In a world where value creation deserves recognition, Treasurenet ensures effort is rewarded—on-chain and in the real world. A financial system where economic output translates into tangible value.

For questions, feedback, or partnership inquiries, please reach out to us at contact@treasurenet.org.